Debt funds are considered low to moderate investment avenues. However, RBI rate cuts can impact your debt portfolio in different and unexpected ways.

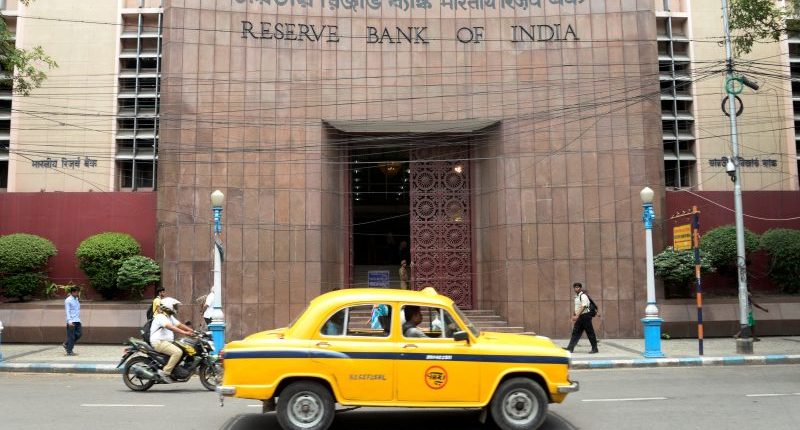

In the last few days, we saw RBI slash the repo rate by 25 basis points (bps) for a second time. They also disclosed their plans to raise liquidity to make sure that the outcome of this rate cut contributes to the real economy.

When liquidity increases for the same debt volume, it brings down the market interest rates. Consequently, the old bond value (especially long-dated bonds) will also drop. Seasoned investors who purchased such long-term bonds will have already made sufficient gains; this is possible as the rate cut has previously worked in favour of the market yields.

Also Read: RBI on linking home, auto loans with external benchmarks

Investors opt for debt schemes for their stable and assured income or a higher return at the end of tenure. So, the investor chooses a scheme based on his/her goal. For instance, some fixed deposits (FDs) and other savings schemes by government enable you to go for a fixed rate throughout the tenure, while some schemes go for quarterly review of interest rates.

Non-convertible debentures (NCDs) also allow you to lock-in better yields just like FDs. Industry experts think that debt-leaning investors can consider higher-rated NCD to tap the benefit of rates north of 9%. However, you need to keep an eye on its credit risk as well as compare the post-tax returns with that of FDs and small saving schemes by the government.

The recent rate reduction has raised two concerns for long-term investors seeking overall returns on investment. Can they opt for long-duration or gilt funds to get the benefit of this continuing rate slashing cycle? Mutual fund experts recommend a cautious and moderate approach in the beginning – through short or medium-term schemes in the beginning.