It is common knowledge that most millennials don’t know much about the world of investing. A general wariness may also have contributed to the lack of interest in investing among them. Systematic Investment Plan or SIP can be an ideal investment avenue as you can start small with manageable amount regularly.

Here are more reasons for a first-time investor to start with SIPs.

Financial discipline

Let’s assume next Christmas, you and your friends have decided to go to Bali for a long overdue get-together. Assuming you plan on having the greatest time in Bali, we’ll put the cost of the holiday at Rs 1,00,000. Now suddenly procuring this amount days before you leave is going to be a huge pain, right?

The same amount could be easily accumulated over a period of a year if you put away a minimal amount every month. With SIP, this is exactly what you’d be doing. This fixed investment familiarizes the investor with financial discipline and financial planning at the most basic of levels.

The power of compounding

Compounding interest is a nifty little trick that veteran investors have been taking full advantage of. It means earning on interest accumulated by reinvesting the interest earned along with the investment amount. Experts always suggest investing early and taking advantage of compounding interest to meet your long term goal.

Suppose you start investing Rs 10,000 every month in an equity scheme to meet a goal that is 10 years away. If your investment generates 12% returns, you would get around Rs. 23,00,390 at the end of 10 years.

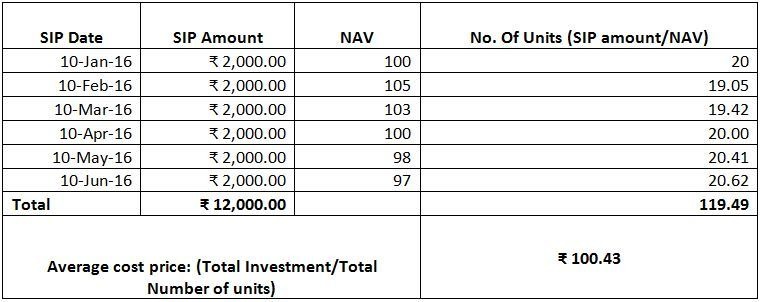

Averaging your purchase cost

The market is famous for its mood swings. Most investors try to beat the market by timing the fluctuations, buying when it’s low and selling when it’s high; this requires both skill and a load of luck. Sure, the up and downs can be predicted to a point, but they will only be predictions.

But for a layman, taking their first step into the hurricane that is the market, making the simplest prediction can be extremely difficult. Your best bet would be to average out the purchase cost over a certain time period. If the NAV price fluctuates between Rs 97 and Rs 105, and you have invested Rs 2000 every month your average cost price would be:

Don’t let the daunting image of the investing sphere scare you. Find a safe haven SIP and take your first steps into the world of investing.