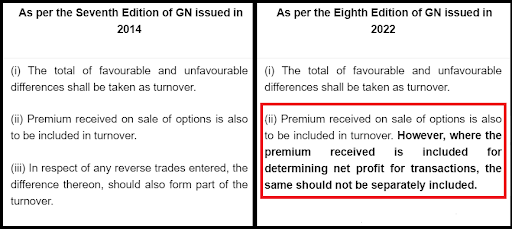

Finally, some good news for options traders as the Institute of Chartered Accountants of India (ICAI), in its recent guidance note, has clarified the meaning of turnover for options writers. Here’s a comparison of the new meaning with the erstwhile:

Consequent to the above change, the premium received will now be considered only once, i.e. for determining net profit. Earlier, the premium was considered in both points (i) and (ii) above.

For better comprehension, consider this example:

| Trades | Purchase Value | Sales Value | Gain / (Loss) | Turnover |

| (1) | (2) | (3) | (4)=(3)-(2) | (5) =(4) |

| Call Option | 2,00,00,000 | 3,00,00,000 | 1,00,00,000 | 1,00,00,000 |

| Put Option | 55,00,000 | 52,50,000 | (2,50,000) | 2,50,000 |

| Call Option sold/written (Not squared off) | – | 15,00,000 | – | 15,00,000 |

| Total | 27,50,000 | |||

Here’s a quick brief on tax audit applicability for option traders:

Turnover up to Rs. 2 Cr

- If you have incurred a loss or the profit is less than 6% of turnover and, other total income is more than the basic exemption limit, a Tax Audit is applicable.

- If you have a profit of 6% or more of the turnover, Tax Audit is not applicable.

Trading Turnover is more than Rs. 2 Cr but up to Rs. 10 Cr

- If you have incurred a loss or the profit is less than 6% of turnover, the Tax Audit is applicable.

- If the taxpayer has a profit of 6% or more of turnover and does not opt for the Presumptive Taxation Scheme of Sec 44AD, then Tax Audit is applicable.

- If you make a profit of 6% or more of turnover and opt for the Presumptive Taxation Scheme under Sec 44AD, Tax Audit is not applicable.

Trading Turnover is more than Rs. 10 Cr

Tax Audit is applicable regardless of the profit or loss.

For any clarifications/feedback on the topic, please contact the writer at ektha.surana@clear.in

Pursuing CA alongside my passion for content writing. Here, I ship some interesting content your way on topics- tax, personal finance and the likes .

Find my peace and energy in exploring culinary arts, anything fitness, post-card worthy places, books, indie music and more.