Want to improve your credit score? Spending less on your credit card can help raise your creditworthiness. I’ll explain how.

The credit bureaus factor in your Credit Utilisation Ratio while determining your credit score. The lower the credit utilisation ratio, the better the credit score.

What’s Credit Utilisation Ratio (CUR)?

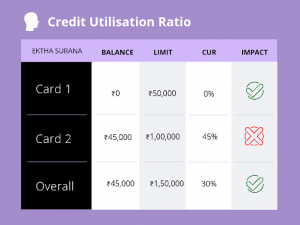

The credit utilisation ratio is the total amount of credit you’re using to the total amount of credit.

Credit Utilisation Ratio =Total credit utilised/Total available credit

Ex: Let’s say you utilise ₹50,000 out of ₹1,00,000 credit limit on a card. The CUR is then 50%. This ratio is calculated for each card separately and as a whole for all of your credit cards.

How much Credit Utilisation Ratio should you ideally maintain?

The ideal ratio to help you improve or maintain your credit score is 30% and, fortunately, not 100%.

Following are some suggestions for lowering your Credit Utilisation Ratio:

- Use no more than 30% on a single card. It is not a good idea to max all your credit cards.

- A low ratio is preferable over a closed card for your CUR. So it is better not to close a card or spend on all cards.

- On-time credit card payments help increase the credit limit. This will help improve the CUR, provided you don’t inflate your expenses.

For any clarifications/feedback on the topic, please contact the writer at ektha.surana@clear.in

Pursuing CA alongside my passion for content writing. Here, I ship some interesting content your way on topics- tax, personal finance and the likes .

Find my peace and energy in exploring culinary arts, anything fitness, post-card worthy places, books, indie music and more.