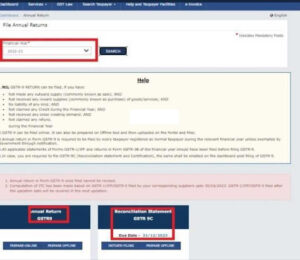

The GST Network (GSTN) has enabled filing forms GSTR-9 and GSTR-9C on the GST portal as per an update on 16th May 2023. After logging into the government portal, many taxpayers could find the annual return tile activated on their return filing dashboard upon selecting the financial year, as displayed below.

If you want to explore the facility, navigate to your return dashboard after logging into the government GST portal. Click on the tile labelled GSTR-9 for FY 2022-23 and begin preparing the annual return for the financial year 2022-23.

The due date for Annual GST Filing

It is pertinent to note that the due date to file GSTR-9 for FY 2022-23 is 31st December 2023, as per the GST law. However, early filing of the annual returns in GST has many benefits. Most importantly, regular taxpayers must finish vital GST-related tasks between September-November 2023 which can delay or complicate the annual return filing. Beginning with those tasks ahead of the deadlines will ensure accurate and timely compliance.

Background to Annual GST Filing

Form GSTR-9, or the annual GST returns, are filed by taxpayers with an annual turnover of more than Rs.2 crore for FY 2022-23. At the same time, form GSTR-9C or self-certified reconciliation statement must be filed by taxpayers with an annual turnover of over Rs.5 crore for FY 2022-23. There is both online and offline/Excel utility option for filing the annual return and reconciliation statement. The CBIC authority has notified the opening of the filing facility for those ready to file these forms.

A quick annual GST filing 22-23 checklist

No matter the size, businesses should complete the annual GST reconciliation for the entire financial year of 22-23 before preparing the forms GSTR-9 and GSTR-9C. For FY 22-23, taxpayers have time until October 2023 returns due in November 2023 for claiming missed Input Tax Credit (ITC), reporting corrections, or any omitted GST data through GSTR-1 or/and GSTR-3B.

However, the process involves data consolidation and massaging it into a requisite format,

Reconciling or matching different data sets, taking suitable actions for discrepancies that may involve continuous vendor follow-ups and the final filing of returns for a huge volume of yearly data for FY 2022-23.

Data sets such as monthly/quarterly GSTR-1, GSTR-2A and GSTR-3B are compared with the sales register/purchase/expense register from April 2022 up to 30th October 2023, for about nineteen months.

Specifically for GST annual filing, there are additional tasks, such as filling up the annual forms in the requisite notified format without missing any data. Large taxpayers must compare draft GSTR-9 with audited financial statements for GSTR-9C reporting.

All these become tedious and time-consuming if taxpayers perform them manually.

4 reasons why early annual GST filing is essential

The early filing of GSTR-9 and GSTR-9C has become a necessity due to the following reasons-

- Instead of waiting closer to the due date to run the above reconciliations, run yearly reconciliations sooner to identify all discrepancies on FY 22-23 and communicate with vendors for fixes.

- Rectify all discrepancies ahead of time and raise amendments in returns if needed.

- Save on the interest expense as the interest incurred at present will tend to be generally less than interest incurred till December’23

- Carry out ITC reversals or report missed invoices.

- Any invoice not declared properly.

- Report any missed ITC claims only after it gets reflected in GSTR-2B and notice a major improvement in the working capital.

The reflection of ITC claims in GSTR-2B takes time and may involve multiple vendor follow-ups. Accordingly, it is essential to complete the annual reconciliation for the FY well in advance. Once the yearly data is reconciled, the taxpayer is at the final stage of annual return filing for preparing GSTR-9 and GSTR-9C, which becomes a cakewalk. Taxpayers would have no cause to wait until 31st December for annual return submissions.

For any clarifications/feedback on the topic, please contact the writer at annapoorna.m@clear.in

Annapoorna, popularly known as Anna, is an aspiring Chartered Accountant with a flair for GST. She spends most of her day Singing hymns to the tune of jee-es-tee! Well, not most of her day, just now and then.