Investors prefer gold as an asset class for diversifying their portfolio and hedging against financial risks. Gold investments delivered strong returns from early 2018 since the US-China trade war. In the year 2020, the gold price rallied about 34% in the rupee terms. The COVID-19 crisis added fuel to the ongoing bull run in the price of gold.

The price of gold in rupee terms largely mirrors the international price in US dollars. Gold price also gets influenced by global factors such as geopolitical tensions, trade wars and pandemic. Trade uncertainties cause financial markets to become volatile, and equity investments turn risky. Traditionally, investors often turn to gold in turbulent times to hedge against financial risks.

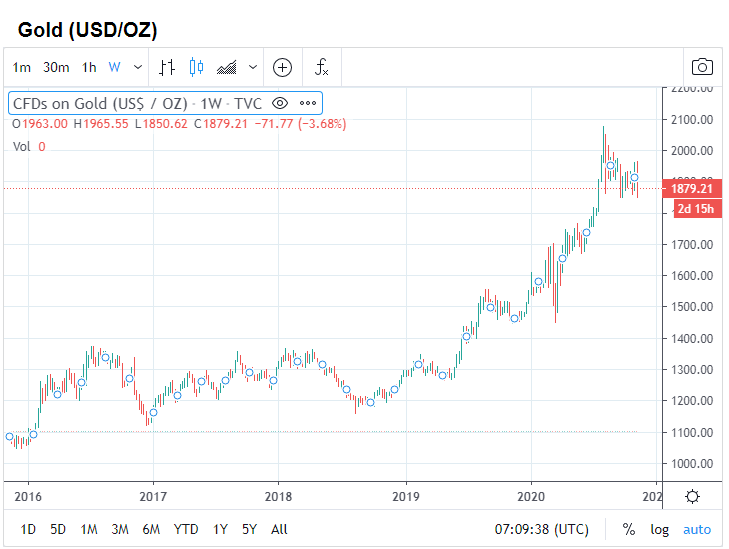

The graph below in US dollar terms indicates the movement in gold prices from 2016 till date. The gold price remained range bound from 2016 till mid-2018. However, the imposition of tariffs by US and trade issues with China boosted the safe-haven value of gold. The gold price had an upward momentum from mid-2018. In 2020, the spread of the pandemic COVID-19 caused significant uncertainty for business across the globe. The gold price rose to an all-time high at USD 2,075. In rupee terms, the all-time high was Rs 56,018 recorded in August 2020.

Source: www.moneycontrol.com

Source: www.moneycontrol.com

Investors seek investments in gold to preserve capital and also to shield the portfolio from volatility in the equity markets.

The other factor which contributed to the increase in gold price is the liquidity or stimulus package announced by governments across the globe. The central banks too eased the lending rates making available low-cost funds. The RBI or Reserve Bank of India also lowered the repo rate to 4%, lowest since the year 2000. Thus, the demand for gold as an asset class rose amidst uncertain trade and investment scenarios.

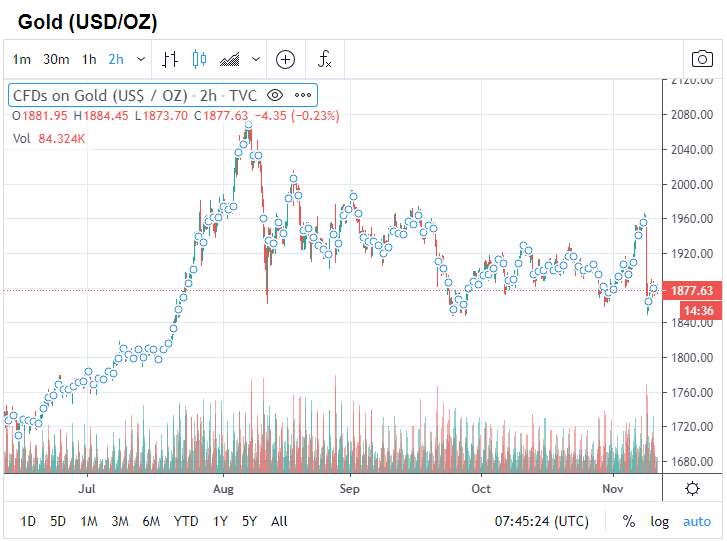

Gold price remains range-bound since touching the high in August 2020 as depicted in the graph below. Though the spread of infections from COVID-19 tapered down, there are reports of a second wave of the pandemic in different countries. Affected countries may announce more stimulus measures, which could be positive for the gold price. Do note that a finding of a vaccine may improve business sentiments and reduce the investment value of gold.

Source: www.moneycontrol.com

Source: www.moneycontrol.com

Gold investments help beat inflation and low returns from fixed-income securities. In a low-interest scenario, returns from fixed-income products such as bank fixed deposits are significantly low. Also, inflation erodes the return in fixed income securities. The interest income also gets taxed as per the slab rates of the individual. In comparison, investments in gold get protected from inflation. The taxes calculated on capital gains on the sale of gold also carry the benefit of indexing cost for inflation for a holding period above three years.

Gold investments can be in physical forms such as gold bars and coins or Demat forms such as Gold ETF, digital gold and sovereign gold bonds.

For any clarifications/feedback on the topic, please contact the writer at sweta.dugar@cleartax.in

I am a Chartered Accountant by profession. I specialise in personal taxes and corporate income tax matters. I am an avid reader and track developments in financial markets, economy and other market developments.