Bank account validation stands integrated with the GST System as per a new GST Network (GSTN) advisory dated 24th April 2023. The move ensures the correctness of the bank account details of all kinds of GST taxpayers.

The advisory has directed taxpayers to check their bank account validation status on the portal. For the same, they must go to the FO portal, and on the dashboard, they must click on ‘My Profile’ and select the ‘Bank Account Status’ tab.

Further, the taxpayers can cross-check their GST-registered email address and mobile number to know the status right after validation is carried out to confirm the status. Bank account validation status can be one of four types.

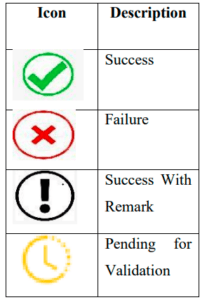

It can be ‘Success’, ‘Failure’, ‘Success With Remark’ or ‘Pending for Validation’. The icons given below appear upon checking the status of bank account validation. One can see details by hovering the mouse over these icons in the Taxpayers’ dashboard in FO Portal.

Where the status is ‘Success’, no further action is required. It means the bank account registered with the GST system is successfully validated and correct.

However, where the status is ‘Failure’, it can be due to more than one reason. Status is ‘Failure’ in case of an invalid PAN or PAN being unavailable in the bank or an invalid IFSC declared.

Another reason for the failure of bank account validation with the GST system is that the PAN registered for GSTIN differs from or does not match the PAN tagged for the bank account.

In case of failure, complete the KYC with the respective bank and re-try bank account validation by ensuring correct bank account details are declared.

On the other hand, where the status is ‘Success With Remark’, it means the bank is not integrated with the National Payments Corporation of India (NPCI) for online validation. Taxpayers can fix this by providing an alternate bank account number with the GST system to allow revalidation for faster online processing.

Suppose one gets ‘Pending for Validation’ status. It means such a person must wait for the account to be validated by NPCI. No time limit is defined for awaiting the validation.

Taxpayers can add or delete bank account details and validate them anytime.

For any clarifications/feedback on the topic, please contact the writer at annapoorna.m@clear.in

Annapoorna, popularly known as Anna, is an aspiring Chartered Accountant with a flair for GST. She spends most of her day Singing hymns to the tune of jee-es-tee! Well, not most of her day, just now and then.