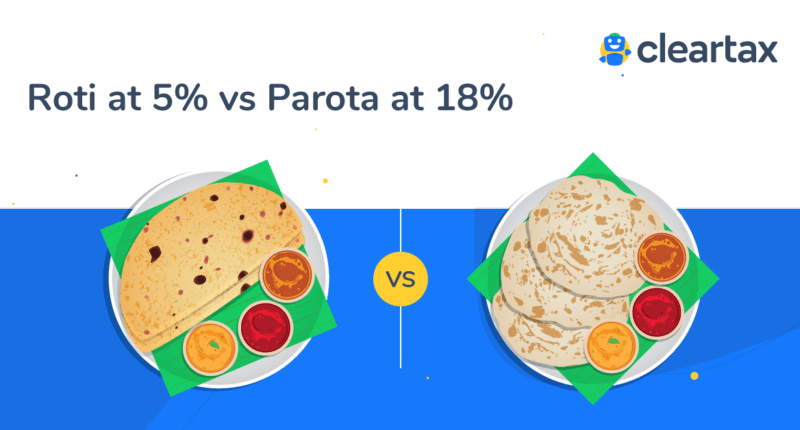

The Advance Rulings Authority (AAR) of Karnataka bench has stated that parotas must attract 18% GST, whereas a roti is taxed at a 5% concessional GST tax slab. The government of Karnataka has ruled differentiating paratha/parota from roti, which are two types of Indian bread and has demonstrated that parota must be taxed at least three times that of roti for GST.

Soon after the news broke, Twitterati turned frenzy with memes pouring in on the taxonomy with hashtags #HandsOffPorotta. Ramesh Srivats @rameshsrivats quoted “ Roti [is charged] at 5% GST, parota [is charged] at 18% GST. Hmm, that would place naan and kulcha at 28% [GST]. (No way I’m even looking at Butter Naan and Rumali Roti).”

Another tweet came in from Siddharth Zarabi @szarabi as “Parota & GST-A cautionary tale:

“Do not worry before ordering your next parota at a restaurant. It is charged at the same tax rate as a roti! How? Because, the Authority for Advance [Rulings], Karnataka has held that frozen & preserved wheat [parotas] & their [Malabar] cousins that are sold in a packaged form, with a [sell-by] date, are not plain rotis but a distinct product on which 18% GST is to be paid! […..]. Frozen foods [cannot] be compared with a plain roti/parota served in restaurants on a day-to-day basis [….] Plain roti, parota served at restaurants/takeaway have a GST of 5% only. (After [all, ] what does a man need to survive, but for roti, data aur mobile!)”

Most of the food items are charged nil GST, especially those of essential and unprocessed character. But processed foods, depending on the product, attract higher rates of 5%, 12%, or 18%. The Karnataka Bench of the Advance Ruling Authority (AAR), which differentiates between khakhra, plain chapati or roti and parota, has reasoned that ready-to-eat parota needs to be heated or further processed for human consumption and is, therefore, liable for 18% GST.

Also Read: The Rise of the PPE Industry in India Amidst COVID-19 Havoc

Advance rulings specifically apply to the person who has sought the ruling after considering all the facts and circumstances about that case. But the business community can draw cues from the possible classification of goods or services expected of a particular item of description. In no way can these bind other businesses or taxpayers into the same line of supply activity since these are not judgements.

In this case, the Karnataka advance rulings order no. 38 dated 22nd May 2020 pertains to classification of the goods, and it attracts Section 97(2)(a) of the CGST Act, 2017.

Bengaluru-based ID Fresh Food (India) Pvt. Limited is a food products business engaged in the preparation and supply of ready-to-cook items such as idli and dosa batter, parota and chapatis. It had approached the AAR as to whether whole wheat parota and Malabar parota (refined floor) preparations could be listed under Chapter 1905 attracting 5% GST. Ingredients used in the preparation of the Malabar parota include refined flour, RO purified water, edible vegetable oil, edible salt and vegetable fat.

According to the Karnataka bench, the parota is not protected by any other heading under the HSN scheme and must also be processed for human consumption. So, it must be charged under heading 2106 and not heading 1905, which includes foods such as cakes and pastries that are fully cooked foods and ready for consumption.

Taxation is correlated with economic activities such as disposal, development, income, benefit, etc. Laws can aim to cover actual or planned products, services, or businesses. But entrepreneurs are creators, companies are continually changing, and every single day new products and services are created and brought to market. Tax laws cannot think ahead or cover all variations in advance.

Ideally, when a Heading Reference is adopted, the entry in the notification providing exemption or concession should cover all goods in the Chapter Heading. Accordingly, it is a famous principle that if the definition of a particular expression is not available in the statute, it must be understood in its popular or common sense, i.e., how those who produce or deal with those goods use that expression every day.

Hence, unless the CBIC comes out with any clarification about the GST rate applicable on parotas, a taxpayer can apply GST rate as per the common trade parlance.

For any clarifications/feedback on the topic, please contact the writer at annapoorna.m@cleartax.in

Annapoorna, popularly known as Anna, is an aspiring Chartered Accountant with a flair for GST. She spends most of her day Singing hymns to the tune of jee-es-tee! Well, not most of her day, just now and then.