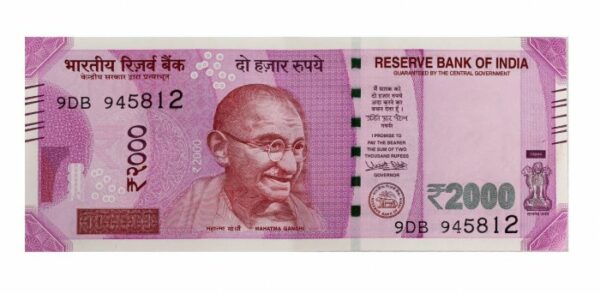

The Reserve Bank of India (RBI) has extended the date for deposit or exchange of Rs 2,000 banknotes at bank branches till October 7, 2023. Earlier, the last date for the banks to provide deposits and exchange Rs 2,000 currency notes was till September 30, 2023.

The RBI has maintained that a total of Rs 3.42 lakh crore has been received back from the Rs 3.56 lakh crore of Rs 2,000 banknotes in circulation as of May 19, 2023. At least 96% of the Rs 2,000 currency notes in circulation have since been returned.

Although after October 7, 2023, the Rs 2,000 notes will continue to remain legal tender, they will not be accepted for transaction purposes and can only be exchanged with the RBI.

The apex bank stated that from October 8, Rs 2,000 banknotes will continue to be exchanged by individuals at 19 RBI Issue Offices — up to a limit of Rs 20,000 at a time. These currency notes can also be tendered at the Issue Offices for credit to their bank accounts in the country for any amount.

In addition, individuals can also send the banknotes via India Post to any of the 19 Issue Offices for credit to their bank accounts.

On May 19, 2023, the central bank decided to withdraw the Rs 2,000 denomination currency notes from circulation. However, it maintained that it would continue to remain as legal tender. The RBI had advised banks to stop issuing Rs 2,000 banknotes with immediate effect.

Introduced in November 2016, the idea to print Rs 2,000 notes was to meet the currency requirement of the economy expeditiously after the demonetisation of all Rs 500 and Rs 1,000 banknotes.

Over a period, the objective of introducing Rs 2,000 banknotes was attained once banknotes in other denominations became available in adequate quantities. Therefore, the printing of Rs 2,000 banknotes was halted in 2018-19.

Rajiv is an independent editorial consultant for the last decade. Prior to this, he worked as a full-time journalist associated with various prominent print media houses. In his spare time, he loves to paint on canvas.