The new tax regime was introduced in April 2020, and the new tax slabs were unveiled in the Annual Budget 2021-22. However, the Central Government, in the Union Budget 2023-24 made a few changes in the new tax regime in a bit to encourage more taxpayers to go in for it.

The changes introduced included streamlined tax slabs, a higher tax rebate limit, a standard deduction, a family pension deduction, and a higher leave encashment exemption.

Despite introducing the new tax regime, the Central Government continued with the old tax regime. So, taxpayers now have the option to opt for the old tax regime as well as the new tax regime.

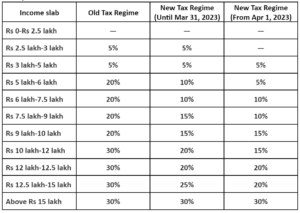

Income tax slabs:

For taxpayers, the selection between the old tax regime and the new tax regime can depend on the deductions and exemptions.

For instance, taxpayers who have invested in tax-saving schemes, the old tax regime continues to remain suitable, while for those with no investment in tax-saving schemes, the new tax regime is relatively better.

Although the tax rates prescribed for a taxpayer under the new tax regime are lower as against the old regime, the new personal income tax regime comes with a cost. For example, under the new tax regime, an individual taxpayer is required to forego certain tax deductions and exemptions under Section 80C, 80D, of the Income-Tax Act (ITA), 1961 and House Rent Allowance (HRA) exemption, etc.

An individual taxpayer can undertake the choice between the old and new tax regimes after a detailed comparative analysis and examining various factors like investment preferences, the tax slab rate, and the scope of deductions available under the old tax regime.

Ideally, taxpayers falling under higher tax slabs and availing limited deductions and exemptions could consider opting for the new tax regime, while those with greater investments in tax-saving tools like the Provident Fund (PF), Public Provident Fund (PPF), Equity-Linked Saving Schemes (ELSS), etc., could find the old income tax regime a more viable option.

Besides, the income tax department has also come out with a tax comparison utility, which is available on its official web portal.

Rajiv is an independent editorial consultant for the last decade. Prior to this, he worked as a full-time journalist associated with various prominent print media houses. In his spare time, he loves to paint on canvas.