Big news for taxpayers! The income tax department recently introduced a ‘Pay Later’ feature on its e-filing portal, granting individuals the liberty to defer the payment of income taxes. Now, you can file your tax return first and pay the taxes later. This means you can finish the filing process and then take care of the taxes you owe, but there are some important things to know.

Who Can Use It?

This feature exclusively applies to self-assessment tax payments made during the ITR filing. Unfortunately, the option is not available for other types of tax payments like advance tax and TDS.

What to Watch Out For?

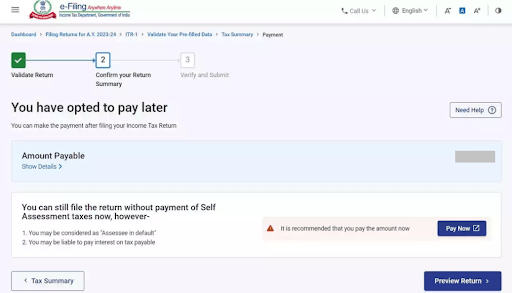

Opting for this route may result in certain implications

- Firstly, the taxpayer may be deemed an “assessee in default”.

- Secondly, interest on the pending tax amount could be levied on the outstanding tax dues. Such a classification empowers the income tax department to initiate recovery measures for the due taxes.

What Happens After You File?

Post ITR submission, taxpayers can expect to receive an intimation notice once their filing is processed. This communication will underscore any outstanding tax liabilities and urge prompt payment. Taxpayers are granted a grace period of 30 days to settle their income tax dues without incurring penal interest. 1% penal interest on tax dues might be applicable. Furthermore, if the payment surpasses the 30-day window, an additional 1% penal interest could be levied.

The income tax department has not explicitly set a time limit for paying tax dues under the “pay later” option. To stay on the safe side, it is recommended to settle tax dues in the same month as the ITR filing.

How to Use “Pay Later” on Income Tax Portal?

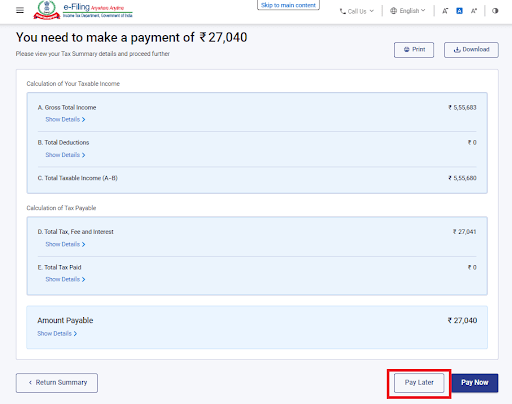

Here’s a simple guide to using the ‘Pay Later’ option on the e-filing portal:

- Go to the income tax website and log in.

- Click on the “e-file” option, choose “income tax return,” and then “file income tax return.”

- Fill in all the details about your income and deductions. The website will calculate how much tax you need to pay.

- You can choose “Pay Later” or “Pay Now.” If you pick “Pay Later,” you can finish filing your return without paying the tax right away.

5. Once you’ve chosen “Pay Later” and filed your return, don’t forget to verify it using one of the six options available.

Taxpayers have two methods to settle their income tax dues after utilising the “pay later” feature:

- e-pay tax method: Upon successful ITR submission, taxpayers can navigate to the e-pay tax section to fulfil their pending tax obligations. You may refer to this guide.

- Wait for a tax notice: If they’ve processed your return and sent you a notice, you’ll have to pay through this method. Just remember, there might be interest and penalties if you delay.

It’s important to note that while the demand notice can result from using the “pay later” option, it could also stem from other tax adjustments undertaken during ITR processing. As such, the notice is not exclusive to this specific feature.

In simple terms, this new option lets you finish your tax filing without paying right away, but it’s important to be aware of the rules and deadlines to avoid extra charges.

For any clarifications/feedback on the topic, please contact the writer at ektha.surana@clear.in

Pursuing CA alongside my passion for content writing. Here, I ship some interesting content your way on topics- tax, personal finance and the likes .

Find my peace and energy in exploring culinary arts, anything fitness, post-card worthy places, books, indie music and more.