The IRDAI (Insurance Regulatory Development Authority of India) issued a circular advising all the insurance companies for issuing Digital Insurance Policies through DigiLocker. In the circular, the IRDAI also stated that the insurers should enable their IT systems to interact with the DigiLocker facility to promote it. This facility allows the policyholders to use DigiLocker for storing all their policy documents digitally.

IRDAI also stated that the insurers need to inform their retail policyholders about the DigiLocker facility and its usage. For the adoption, the DigiLocker team in the National e-Governance Division will provide all the necessary logistics support and technical guidance.

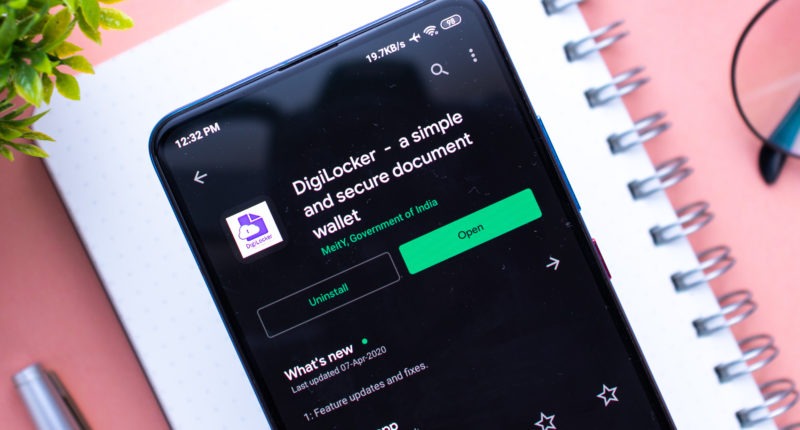

The DigiLocker facility is an initiative by the Ministry of Electronics & Information Technology (MeitY), Government of India under the Digital India Programme. Under the DigiLocker facility, the citizens will get genuine certificates or documents from the original issuers of these certificates in digital format. This facility aims to eliminate or minimise the use of physical documents which will help the effectiveness of service delivery. It will make things easier and friendly for the citizens and provide hassle-free delivery of the documents.

The introduction of DigiLocker in the insurance sector will eliminate customer complaints relating to non-delivery of policy copy, reduction in costs, and better turnaround time of insurance services. It also helps for improving customer contactability, faster processing of claims and settlement, reduction in disputes and fraud. Overall it will lead to a larger customer experience.

The decision of IRDAI to introduce the DigiLocker facility is due to the letter written by Shri. Sanjay Dhotre, Minister of State for Electronics & IT to Shri. Anurag Singh Thakur, Minister of State for Finance and Corporate Affairs. In this letter, Shri. Sanjay Dhotre requested Shri. Anurag Singh Thakur for advising IRDAI to make the DigiLocker facility available to all the policyholders and accept the documents issued through it as valid documents.

DigiLocker provides an alternate channel for customers to manage and access all their insurance policies in an authentic safe manner. It will be of huge value to the customers. The insurance certificate is an important document for the customers and their families. Access to insurance certificates on time is of critical importance. The DigiLocker facility helps customers to access documents on time, resulting in significant convenience to customers.

The introduction of the DigiLocker facility in the insurance sector is a good move by IRDAI. This facility will help customers significantly to keep and manage their insurance certificates in a better manner. As they can access these documents easily, it will greatly reduce the time and procedures during the processing of claims and settlement. It also benefits the insurers as it provides ease of delivery of documents and tracking frauds. DigiLocker is beneficial for both the customers and the insurers.

For any clarifications/feedback on the topic, please contact the writer at mayashree.acharya@cleartax.in

I am an Advocate by profession. I interpret laws and put them in simple words. I love to explore and try new things in life.