The interim budget 2024 was unveiled on 1 February 2024 amidst optimism for potential relief in the personal taxation landscape, especially tax reforms under the new tax regime, by including additional deductions. However, much to the surprise of the consumers and industries, the FM delivered a muted budget regarding personal tax reforms, maintaining a status quo on the tax reforms.

Background to Interim Budgets

Interim budgets, often considered a precursor to the full-fledged budget, are crucial in maintaining fiscal stability during transitional periods. While they address immediate concerns and set the stage for the comprehensive budget, major tax reforms are conspicuously absent from these interim financial blueprints.

Interim or follow-on budgets are presented during the political transition, and introducing major tax reforms during these periods carries the risk of politicisation. These are formulated to maintain economic stability rather than experiment with radical reforms. Designed for short-term stability, these usually lack the mandate and authority to implement sweeping tax changes.

Interim Budget 2024 vs Past Interim Budgets

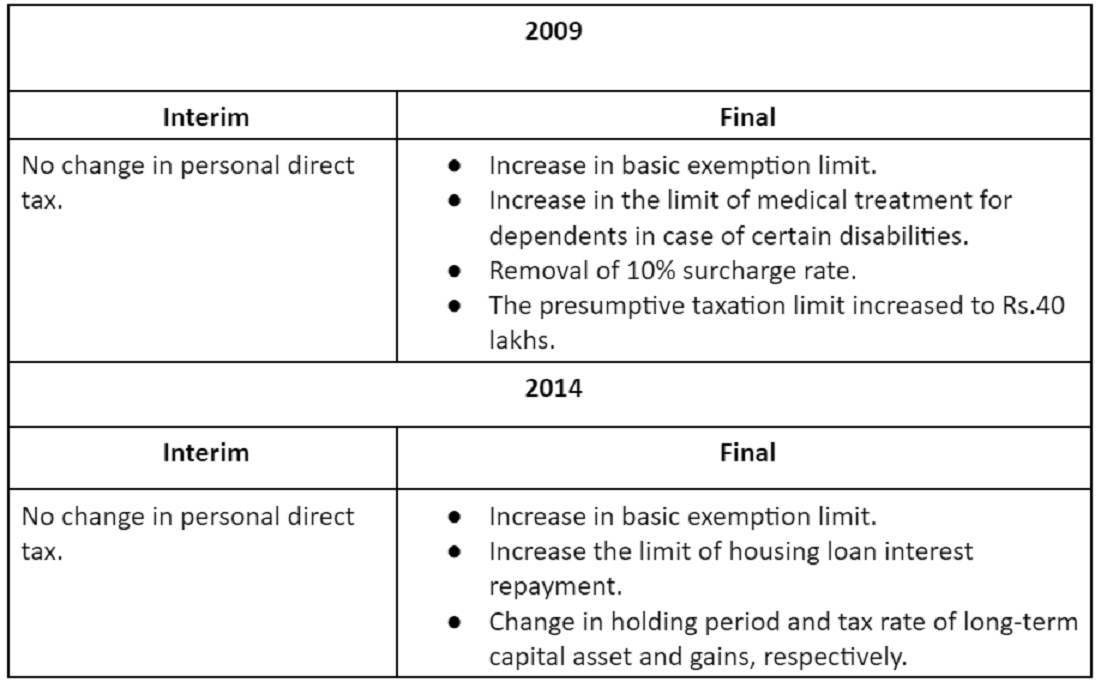

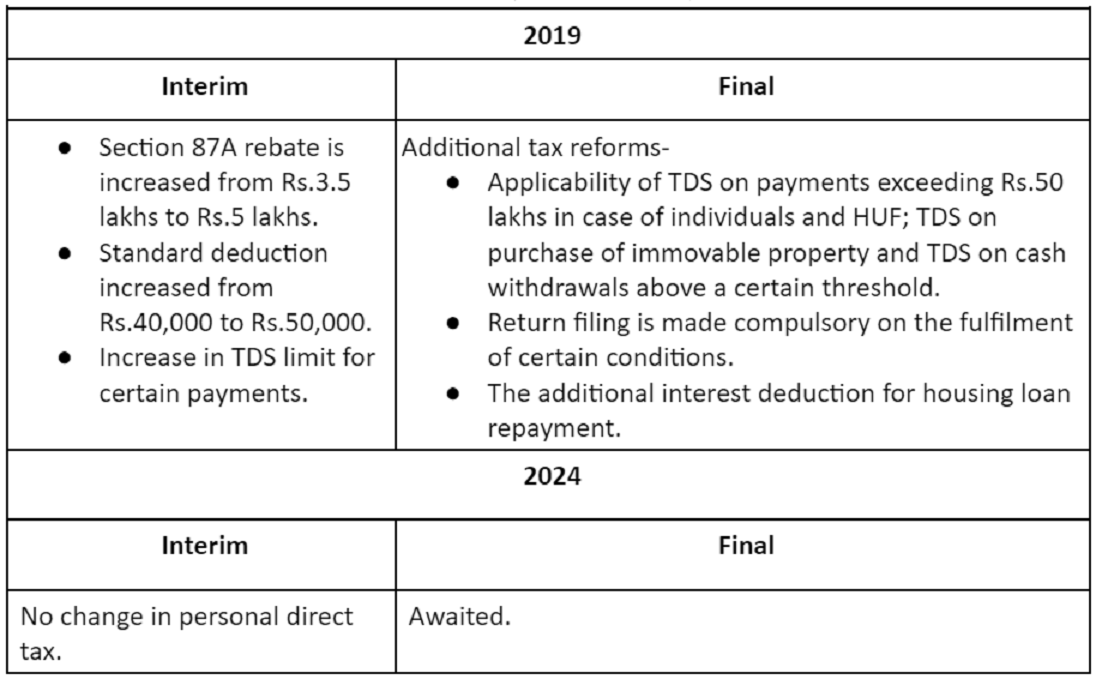

Let’s delve into a comparative analysis of preceding interim budgets from 2009 to 2019 with the successive budgets for those years.

Personal tax reforms under various Interim and Final Budgets

From the above table, it becomes amply clear that the interim governments have preferred to maintain a status quo without proposing whirlwind reforms in the interim budget. However, the budget following the interim budget has brought significant relief to the taxpayers.

Decoding the Interim Budgets from 2009 To 2024

The focus areas of each interim budget from 2009 to 2024 reflect an intricate interplay of economic dynamics, political priorities, global challenges and the strategies employed to achieve sustained growth and development. The larger theme of these budgets has been achieving fiscal discipline while steering clear from populist measures.

The interim budget of 2009 was crafted against the backdrop of the global financial crisis. The primary focus was on providing an economic stimulus. The interim budget in 2014 reflected a focus on fiscal prudence and inclusive growth.

The interim budget of 2019 aimed at boosting consumption and addressing agrarian distress. Lastly, the interim budget of 2024 has marked a pivotal moment in the economic narrative post the global pandemic.

While interim budgets are vital in maintaining economic equilibrium during transitional phases, their nature as interim measures imposes certain limitations. The strategic decision to defer major tax reforms during these periods is a careful balancing act, aiming to preserve stability, avoid unnecessary controversies, and ensure that transformative changes align with a more comprehensive and considered fiscal vision in the subsequent full-fledged budgets.

Annapoorna, popularly known as Anna, is an aspiring Chartered Accountant with a flair for GST. She spends most of her day Singing hymns to the tune of jee-es-tee! Well, not most of her day, just now and then.