When a business entity refurbishes and resells the same product, tax is charged on the total value of the product, which results in double taxation. The Goods and Services Tax (GST) Law has a ‘margin scheme’ provision that intends to resolve double taxation. The margin scheme model applies to the person who is into the purchase and sale of second-hand commodities. In this scheme, the GST is calculated on the difference between purchase value and re-sale price of used goods.

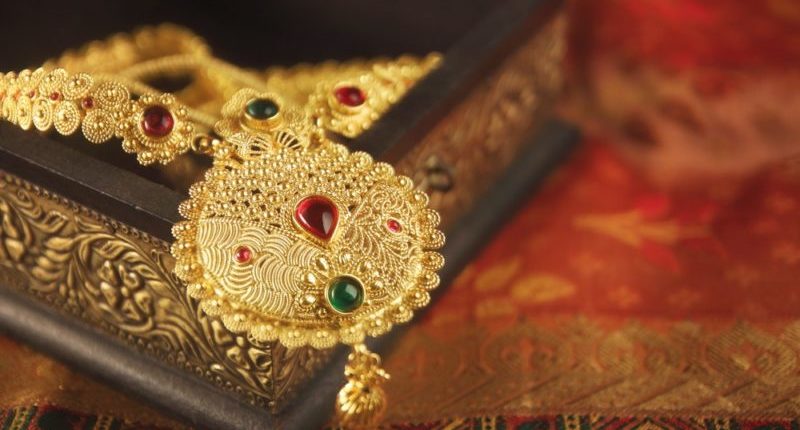

M/s Aadhya Gold Pvt Ltd (applicant) was engaged in buying used/second-hand gold jewellery from unregistered persons, i.e., commoners. The applicant is in the business of selling used/second-hand gold jewellery purchased from people. The applicant used to sell such gold ornaments after cleaning and polishing but without altering the nature of the ornament.

The applicant approached the Karnataka Authority of Advance Ruling (AAR) to seek whether GST is charged on the total value or difference between purchase and sale prices when they purchased and sold used or second-hand jewellery.

Karnataka AAR observed that the applicant was not melting the old jewellery and recreating it into new jewellery. Also, the applicant is just cleaning and polishing the old jewellery without changing the nature or form of the jewellery purchased. Thereby AAR held that in this case, the applicant could avail margin scheme, and GST is payable only on the margin between the purchase and sale prices.

This ruling will lead to a significant reduction in the GST payable on the purchase of old gold, which is primarily considered an investment in India. At present, the industry is charging GST on the gross sale value of second-hand gold irrespective of the underlying facts.

For example, XYZ & Co., a jeweller, has bought second-hand jewellery from an unregistered customer Mr A. amounting to Rs.5,000. XYZ & Co. sells the same jewellery after cleaning and polishing for Rs.7,000. XYZ & Co. will only be liable to pay GST on the difference between the sale price and purchase price of used gold, which would be (7,000-5,000)= 2,000.

This ruling may not be favourable to big players in the industry as they will generally melt the old jewellery to create new jewellery. Melting old jewellery constitutes a change in form, and accordingly, this transaction does not qualify for a marginal scheme. Thus, in such cases, the purchaser of gold has to pay GST on the gross value. However, this ruling will help small players in the used gold business of reselling the old gold on an ‘as is’ basis.

The department should track and monitor dealers in the industry who are melting their jewellery, use it to make new jewellery and continue paying GST under the marginal scheme. Otherwise, this would result in a significant revenue loss for the department in the long-run perspective.

For any clarifications/feedback on the topic, please get in touch with the writer at dvsr.anjaneyulu@cleartax.in

DVSR Anjaneyulu known as AJ, is a Chartered Accountant by profession. Loves to listening to music & spending time with family and friends.