Until recently, taxpayers could download e-way bills for a limited period at five-day intervals. This caused taxpayers hardships as they needed to download e-way bills several times a month. The e-way bill portal has now enhanced this facility by giving taxpayers the option to download e-way bills for one month, with a single click.

The e-way bill portal is run by the National Informatics Centre (NIC). It is used by suppliers, transporters and other persons required to generate e-way bills for the transportation of goods exceeding Rs.50,000 per consignment. For certain specified goods, e-way bills need to be mandatorily generated even if the value of the shipment of goods does not exceed Rs.50,000.

Also Read: Offline Matching Tool to compare ITC in GSTR-2B with Purchase Register

As several taxpayers had been suggesting that the e-way bill portal increases the period for which taxpayers can download e-way bills at a single time, the portal finally enhanced the limit. Taxpayers can download the e-way bills in an Excel format, for use on their systems. However, this facility is only available between 8 a.m. and 12 p.m., to not disrupt the normal working of the portal.

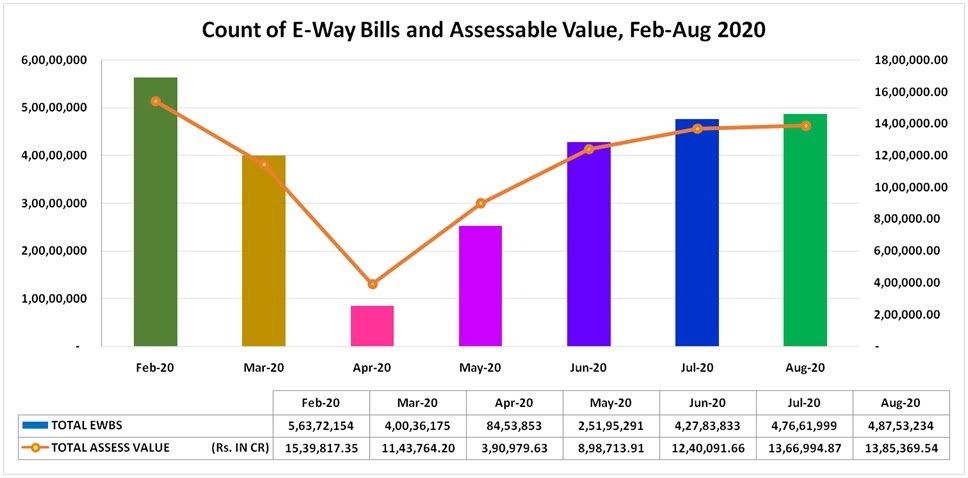

The e-way bill system in India had been generating around 5 crore e-way bills on a monthly average. During the government-imposed lockdown in April-May 2020 due to the coronavirus pandemic, the portal saw a slump which indicated the non-movement of goods. From June 2020, the generation of e-way bills has been gradually picking up, and the volume is now almost back to normal in September 2020.

Source: GSTN

For any clarifications/feedback on the topic, please contact the writer at athena.rebello@cleartax.in

I’m a Chartered Accountant by profession and a writer by passion. ClearTax lets me be both. I love travel, hot tubs, and coffee. I believe that life is short, so I always eat dessert first. Wait.. life is also too short to be reading bios… Go read my articles!