E-invoicing is creating a lot of buzz among indirect taxpayers in recent times. Electronic invoicing is the Indian government’s initiative to revolutionise the way businesses interact with each other.

The system involves specified GST registered taxpayers to mandatorily report all the B2B documents to the common Invoice Registration Portal (IRP). It is managed by the GST Network and currently maintained by the National Informatics Centre.

The specified taxpayers are those with a total turnover of more than Rs.500 crore, covering all the GSTINs of a particular PAN, in FY 2019-20. They must begin complying with the requirement from 1st October 2020.

The IRP will verify and validate the details on the documents such as invoices, debit notes and credit notes reported by the taxpayer. After that, it will generate a unique Invoice Reference Number (IRN) and a QR code for every document. It will also digitally sign the document and send an email or the response JSON to the taxpayer. In turn, the document details will flow into the GSTR-1 and e-way bill portal, if applicable.

Hence, the system reduces efforts of such taxpayers manifold as they need not re-enter most of the details to prepare form GSTR-1. Additionally, the e-way bill generation becomes easier as part-I is auto-populated regularly. Only accurate invoices are processed on the IRP, which will reduce the scope for tax evasion and errors in returns. The QR code on every document will help the tax officials to verify offline conveniently.

The challenges involved are the need to arrange for the backup of IRN separately, segregate B2B documents from B2C at source, and regularly reconcile the e-invoice data vis-a-vis GSTR-1 and e-way bill. There is no facility to amend an e-invoice on the IRP, and the taxpayer must cancel such e-invoice to regenerate a new one.

Also Read: Taxpayers Under Reporting Turnover to Avail GST Compliance Relaxations

Further, the ERP system must keep a regular track of amendments to the documents, including cancellation of invoices and e-way bills for regenerating the e-invoice. The ERP system must be capable of storing the IRN information for future reference and have a reconciliation tool to check differences between e-invoices passed onto the GSTR-1 with the accounts.

The specified taxpayers must be prepared to address the above challenges. This will ensure a smooth transition from the present system of invoicing to the e-invoicing regime. They must choose the best mode of IRN generation much before the actual implementation date. The method chosen must be suitable for their business needs evaluated using the cost-benefit analysis.

The choice will depend upon several factors. One of them is whether the business can afford some lapse of time to generate the IRN or should it be real-time. For the former, the bulk generation tool is apt while for the latter, direct API integration or integration via GST Suvidha Provider (GSP) will suit. Every ERP or billing system must be reconfigured for the notified e-invoice format, especially the mandatory fields and a space for the QR code. The best and cost-effective mode of IRN generation that addresses all these challenges is the e-invoicing software-cum-GSP.

E-invoicing can be a potential game-changer in GST. First of all, there is currently a high dependency on paper invoices for doing business. The use of paper is prevalent even in GST return preparation leading to transcription errors. With e-invoicing in India, GST compliance may become seamless as the time and efforts for preparing returns will drastically reduce.

Secondly, it is likely to boost the revenue collections as the scope for fake invoicing almost gets eliminated. It is because the fake input tax credit claims get reduced, and taxpayers must pay the right amount of taxes.

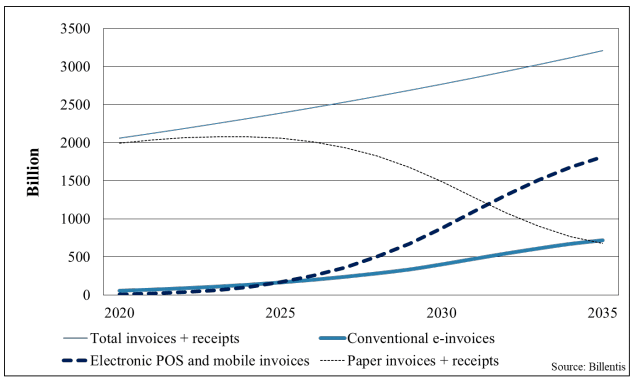

Thirdly, India is adopting the system at the right time to stay in the global race of doing business. The global e-invoice volume is said to multiply by four times as per the recent report by the Bellentis on ‘The e-Invoicing Journey 2019-2025’ studied at an international level. The graph given below suggests a gradual increase in e-invoicing adoption, including both conventional and Point of Sale (POS)/mobile-based systems.

There is a need to integrate systems rather than just conventional e-invoicing (i.e. paperless raising of invoice). These include procurement processes, POS systems, tax processes and the supply chains. But this will take time in India, as a majority of taxpayers fall below the notified threshold limit for e-invoicing implementation. Also, the government must closely monitor the scale of adoption and impact on large taxpayers before extending it to the rest of the taxpayers.

Earlier, the e-invoicing system was slated for an April 2020 launch. Accordingly, few of the large enterprises have shown early adoption of the e-invoicing system. The GSTN has released the APIs for the specified taxpayers to enable integration with the IRP. Apart from the challenges stated above, these enterprises have also observed that they should disengage with the e-way bill system to interface their ERP systems with the IRP portal. Further, they have started training the internal teams about the change in the process flow well in advance. It will help in smooth shift and also lets the organisations, especially large ones, to identify any hiccups in early implementation and fix them.

Hence, the ongoing trend of early adoption of the e-invoicing system will be a positive attempt to kickstart a tested and stable e-invoicing system from 1st October 2020.

For any clarifications/feedback on the topic, please contact the writer at annapoorna.m@cleartax.in

Annapoorna, popularly known as Anna, is an aspiring Chartered Accountant with a flair for GST. She spends most of her day Singing hymns to the tune of jee-es-tee! Well, not most of her day, just now and then.