In addition to marking the new financial year, 1 April 2021 also determines a few new policies, such as the new labour code and change in account numbers for customers of eight banks merged with other big banks.

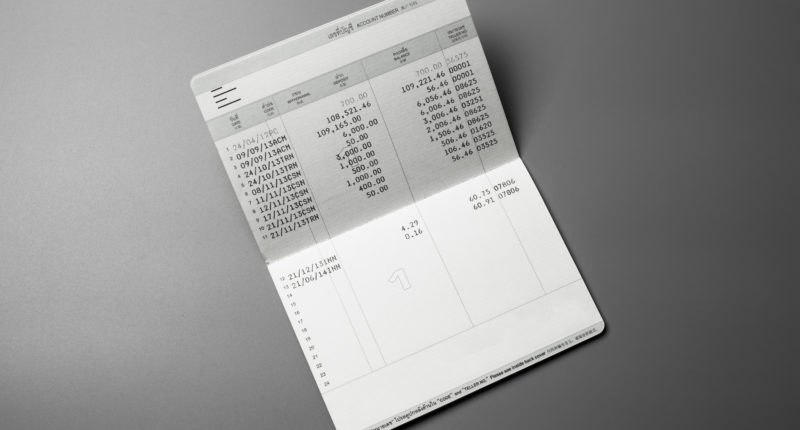

You read it right. Customers of Dena Bank, Vijaya Bank, Corporation Bank, Andhra Bank, Syndicate Bank, United Bank of India, Oriental Bank of Commerce, and Allahabad Bank have to get a new chequebook and passbook to operate their accounts. This is because the existing chequebook and passbook will not remain valid from 1 April 2021.

Punjab National Bank had already alerted the customers stating that the existing chequebooks issued by Oriental Bank of Commerce and United Bank of India are only valid till 31 March 2021. Also, the customers were informed that a new IFSC and MICR code is required to make any transactions post 31 March 2021.

Customer of one of these banks? What should you do?

Update your details, such as contact number, address, name of the nominee, and others, with the bank. Show your old passbook and chequebook at the bank branch to get a new passbook and chequebook that states the bank name after the merger.

Once you receive your new account details through passbook and chequebook, do not forget to update every point where you had provided your bank details, whether it is your employer in the case of a salary account or a financial instrument.

Details of Mergers

Here is a list of banks that were merged in recent years:

- Dena Bank and Vijaya Bank merged with Bank of Baroda.

- Oriental Bank of Commerce and United Bank of India merged with Punjab National Bank.

- Syndicate Bank merged with Canara Bank.

- Andhra Bank and Corporation Bank merged with Union Bank of India.

- Allahabad Bank merged with Indian Bank.

The major reason behind merging 10 public-sector banks (PSBs) into four banks is to have a few bigger and stronger banks than many small banks in the country. With this move, the number of PSBs have fallen from 27 in 2017 to 12 in 2021.

Since there is not much time left for 1 April 2021, get your new chequebook and passbook soon. If you have any confusion in this regard, visit your bank’s website or dial-up and talk to your bank’s customer representative for more information on the process.

We hope your transition goes smoothly!

For any clarifications/feedback on the topic, please contact the writer at apoorva.n@cleartax.in