Apart from the more Goods and Services Tax (GST) on frozen parota, the consumers have to pay more GST for chewing pan masala. Both the Central and State Governments are planning levies to collect money to finance the post-COVID-19 economy rebuilding process.

The ‘demerit and sin’ goods, which also attract 28% of GST, the highest, are now subject to a levy of 60% cess. At the next GST Council meeting, this might go up to 100%. Pan masala with gutka attracts cess at the rate of 204%. There is a chance that the taxes and cess on such items maybe even higher.

The government is also planning to tax the raw produce the non-Virginia tobacco used to make pan masala and gutka too. This raw material is sold directly to producers by farmers and does not pay any taxes.

Also Read: 40th GST Council Meeting: Late Fees Waived on GST Returns, Interest Rates Slashed

Currently, the domestic pan masala and gutka industries are having a business turnover of more than Rs 42,000 crore and are growing annually at nearly 10%. Cigarettes and pan masala, which attract ‘sin tax’ under the GST levy, are not only the revenue department’s major revenue items but one of the biggest employers as well.

Last year an industry survey stated that the tobacco sector is contributing almost Rs 12 lakh crore to the economy and employing over 4.6 crore people.

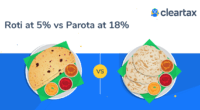

On 13 June 2020, the finance ministry has given clarity that if parota served or sold in a restaurant as ready-to-eat, without the need to further cook or heat, GST would attract just 5% and not 18%. The branded and preserved parota would attract 18% GST.

Earlier, the Karnataka Authority for Advance Ruling (AAR) had held that frozen and stored parota of wheat and parota of Malabar would attract 18% GST. However, in the near future, petrol and diesel do not find themselves on the GST list because neither the centre nor the states are in favour of it.

For any clarifications/feedback on the topic, please contact the writer at dvsr.anjaneyulu@cleartax.in.

DVSR Anjaneyulu known as AJ, is a Chartered Accountant by profession. Loves to listening to music & spending time with family and friends.